Facing Foreclosure: What Most People Don’t Know Could Cost Them Their Home

- Aug 18, 2025

- 5 min read

Let’s be real — most people are too embarrassed to talk about foreclosure.

But life happens.

One minute everything is fine, the next you’re trying to hold your family together while a storm, job loss, medical issue, or unexpected expense threatens the roof over your head.

And if you're a business owner or someone trying to build a legacy — now you’ve got a real storm on your hands.

Because when the personal and the professional collide, the pressure multiplies. You're not just trying to keep a roof over your head — you're trying to keep your business alive, your name clean, and your dreams intact.

But hear me: you are not alone. And more importantly — you are not powerless.

This blog is not about shame. It’s about strategy.

Because most people don’t know that when you face foreclosure, you still have options.

And with the right knowledge, you can buy yourself time, negotiate better terms, and even keep your home.

Let’s walk through the process, step-by-step — no fluff, no shame, just real tools to help you move from crisis to control.

🛑 First, Understand This: Foreclosure Is a Legal Process — Not an Instant Eviction

When a homeowner falls behind on their mortgage, the lender begins a legal process to recover the property — but that process takes time. Contrary to popular belief, you don’t get kicked out overnight, and you do have options.

But here’s the part most people don’t know — and it could save your home:

⚠️ If you submit a complete loan modification application, your mortgage servicer is legally required to pause all foreclosure activity while the application is under review.

This is not just a courtesy — it’s federal law under the Consumer Financial Protection Bureau’s mortgage servicing rules (12 CFR § 1024.41).

As long as you:

Submit a complete application, and

Do it at least 37 days before a scheduled foreclosure sale,

then the bank cannot:

Move forward with a foreclosure judgment

Schedule or conduct a foreclosure sale

Evict you from your home

This is called the “dual tracking restriction,” and it exists to protect you from losing your home while you're actively seeking help.

👉 Here’s the legal source so you can verify it for yourself:

💡 Many families miss this lifeline because they don’t realize how powerful one application can be. Don’t let fear or shame stop you from submitting it — this step alone can hit pause on the clock and buy you valuable time.

📝 Step One: Call and Submit a Mortgage Assistance Application (Form 710)

To begin the loan modification process, here’s what you need to do:

✅ 1. Call Your Mortgage Company

Ask to speak to the Loss Mitigation Department or the Home Retention Department. Different banks call it different things — but this is the department that handles loan modifications and mortgage assistance.

🗣️ Use This Script When You Call:

“Hi, I’ve experienced a temporary financial hardship and I want to apply for a loan modification to keep my home. Can you connect me with someone in the Loss Mitigation or Home Retention Department?”

Once connected:

“I want to request a mortgage assistance application — also known as a loan modification packet. Please send it to me or let me know how to submit it online. And please confirm that foreclosure activity will pause while my application is under review.”

📥 What Is the Mortgage Assistance Application?

This is the actual form that starts the process — often called Form 710 if your loan is backed by Fannie Mae or Freddie Mac.

This form will ask you to explain:

Your current hardship

Your income and expenses

Your household information

The solution you're seeking (loan modification, repayment plan, etc.)

⚠️ TIP: Do NOT Tell the Bank You Can’t Afford It

Most people think telling the bank they can’t afford the home will help them qualify for help. ❌ Wrong. That will hurt you.

Loan modifications are based on the idea that you can afford the new terms.

If you tell the bank, “We can’t pay,” they have no incentive to modify anything — they’ll move forward with foreclosure.

Instead, say this:

“We had a temporary hardship that caused us to fall behind, but we are able and willing to pay under adjusted terms. We’re requesting a modification to bring the loan current and stay in the home.”

That language shows stability. It tells them you’re not giving up — you’re asking for a solution that works for both sides.

📊 For Business Owners: Submit a Profit and Loss Statement

If you're self-employed, don’t just submit your personal bank statements. Include a Profit and Loss (P&L) Statement showing that your business is bringing in income.

The goal is to prove your household can afford the loan, especially under modified terms.

Even if revenue dropped during a storm or economic downturn, your P&L shows you’re back on track or on the road to recovery.

🧾 Types of Hardship — And What Documentation You’ll Need

When you apply for a modification, you must check all hardship types that apply. Here’s what they mean and what documentation (if any) is required:

Hardship Type | What It Means | Documentation Required |

Unemployment | You or your spouse lost your job | None |

Reduction in Income | Reduced hours, lost overtime, or base pay cuts | None |

Increase in Housing Costs | Higher taxes, insurance, or HOA dues | None |

Disaster (Natural or Man-Made) | Hurricanes, floods, or job loss due to storm damage | None |

Long-term Disability or Illness | Ongoing medical condition (self or family) | Written statement; no detailed medical records required |

Divorce or Legal Separation | Marriage ended and affected income | Divorce decree or quitclaim deed |

Separation of Unmarried Co-Borrowers | Co-borrower moved out or gave up the home | Legal agreement or quitclaim deed |

Death of Wage Earner | Death of borrower or spouse | Death certificate or obituary |

Distant Employment Transfer | Job relocation or military PCS | Transfer letter or PCS orders |

If you’ve experienced more than one hardship — check all that apply. The bank wants the full story.

💡 Another Strategy: Request a “Forbearance-to-Modification”

If you need immediate relief but aren’t yet ready for a permanent modification, ask for a forbearance (temporary pause in payments), then roll into a modification after.

This gives you breathing room now, and a lower monthly payment later.

⛔ Don’t Fall for the Shame — Learn the System

This isn’t about begging or blaming. It’s about understanding the system — and how to use it.

Mortgage companies do not want your home. They want money. If you give them a plan that keeps you in the home and keeps them paid — you win.

Don’t suffer in silence. Don’t assume it’s over. You can still fight.

And if no one else told you this before today: you deserve to stay in your home.

🔁 Final Thoughts

You don’t have to be rich to fight foreclosure.

You just have to be informed.

Whether you’re a business owner, a parent, a veteran, or someone just trying to hold it all together — there are options. And the earlier you act, the more power you keep.

If you or someone you know needs help navigating this process, share this blog. And if you’ve got questions, reach out. I’ll help however I can — not always with money, but always with truth, strategy, and the information that actually matters.

📎 Take Action Now

If you or someone you know is facing foreclosure, don’t wait — every day matters.

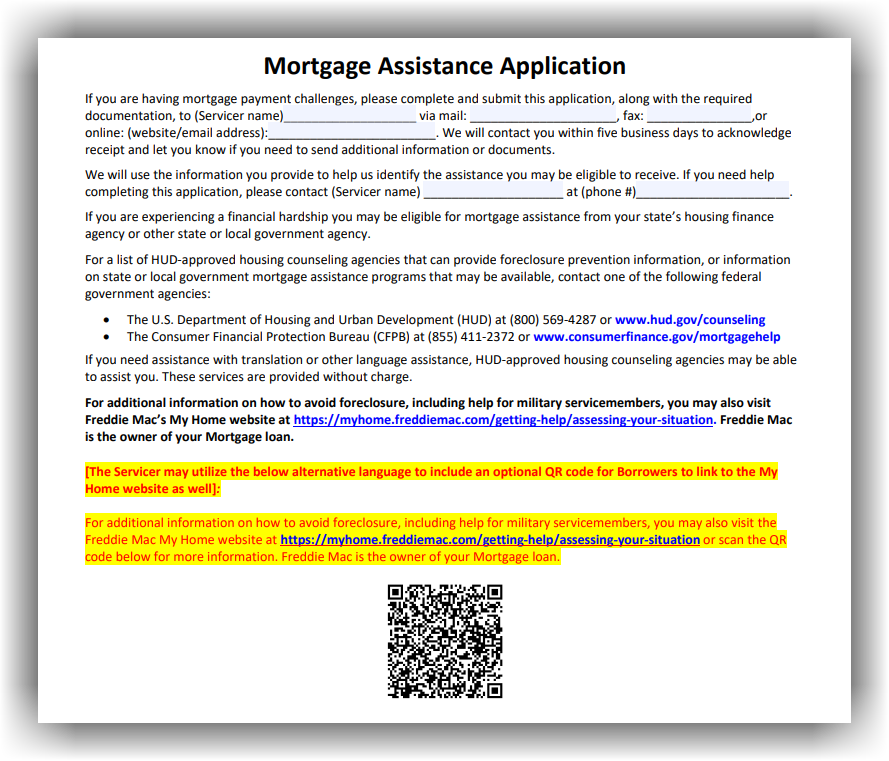

Download and review the attached Mortgage Assistance Application to get familiar with what’s required, the hardship types, and how to position yourself for approval.

Remember: foreclosure doesn’t mean it’s over — it means it’s time to take action. You’ve got options. Now it’s time to use them.

AWESOME INFORMATION